The Golden Keys on When, Where, Why, and How to get a Lower Interest Rate, and How to Use It Wisely.

When you’re searching for a new home, naturally, you want the best deal possible. That’s why it’s essential to consider everything to get a lower interest rate when taking on a mortgage, as it can significantly lower your monthly payment. The good news? You can get the home of your dreams while getting the lowest interest rate possible. Want to know how? I’ve got the inside scoop!

Powerful affects of Credit & Lower Interest Rates to Lower Payment

Before getting into the biggest way to reduce your interest rate which also lowers your mortgage payment because every little bit helps. We are going to cover them all and you want to address these first. Reading this may not be fun, but it’s worth it in the end! You may find one lender who has an lower interest rate while others are higher. Even a fraction of the difference can add up to hundreds and even thousands of dollars over the life of your loan. So start out on the right foot, by making sure your lender is giving you a good, fair interest rate. That is a great place to start. Below I’m going to show you just impactful this is! It’s HUGE and worth it!

Next thing make sure you put yourself in the best position. This isn’t about credit scores but I do need to mention, to get the very best interest rate possible, it also helps to improve your credit score. Your credit score plays a big role in determining what interest rate lenders will offer you. Higher credit scores not only gives you the best start to lower interest rate but it can also affect your mortgage insurance if you not putting 20% down. Check with your lender because some lenders are great at advise, for a quick fix to help with this.

After seeing the best interest rates you have seen in your lifetime, Interest rates are higher than you would like, it even has some people feeling or reality of being priced out of the market to buy their home. I get it but, believe it or not, they are still really great. The problem is the home prices are still high which is double the punch. Those were the lowest interest rates since before 1970, they were such great historic rates!

Did you Know You Can Buy the Interest Rate Down?

Fret not, The good news is, you are not stuck with these interest rates, YOU CAN lower the interest rate by buying it down. How great is that, so let’s talk about all the different strategies to get that lower interest rate and how to use it to your advantage.

Did You Know, The Seller Can Help Lower Interest Rate by Helping You to Buy it Down?

Not only can you buy down the interest rate on your mortgage, but even better, we can try to negotiate with the seller to contribute to buy it down for you. I’ll get into that below but first, let’s look what a huge difference it will make in your payment, BIG!. A year ago, the seller wound not have helped with this because negotiations were nonexistent, due to multiple offers and insane bidding wars! That’s why important to know the market, to know what your best options are. Well, lucky for you, the tables have turned. Under the right circumstances, it is now possible. It is not quite a buyers market yet but there is some play room for negotiations unless a bidding war happens.

A lower interest rate would not only lower your monthly payment, but it will also save you thousands of dollars over the life of your loan. Here is where I’m going to discuss how to make this happen with different strategies you can use this depending on your desired outcome. This allows you to either buy a more expensive home and/or lower your payment. So, let’s get into the different ways you can use this.

A Lower Interest Rate Has a Huge Effect to Lower Mortgage Payment

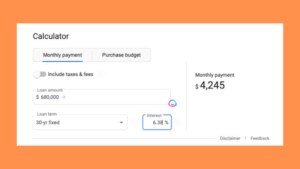

In this first example,

we are only looking at is, a home purchase price of $705,000 with a $25,000 down payment, leaving a financed mortgage balance for the amount of $680,000.

In this is example we are using an interest rate of 6.38 percent, yours may be different depending on lender and when you read this blog.

As you can see your payment would be $4,245 a month for 30 years.

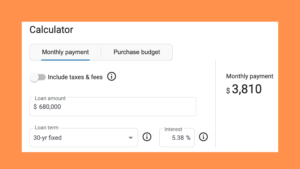

Now in this second example,

everything is the same except the interest rate is 1 percent lower. So now, we calculate with a 5.38 interest rate instead of 6.38%.

As you will see it lowers the mortgage payment from $4,245 to $3810 a month for 30 years. That is savings of $435.00 a month. The change with the lower interest rate, not only is your mortgage payment less per month, but over the 30 years of the mortgage… that is a whopping $156,000 in savings! Not bad, right? Hmmm, think about what you can do with all that money.

Lowering your interest rate by buying it down is a great way to save money and guaranteed to be smart with your money. So if you’re looking for ways to save when buying a home, this here is one of the best other than NOT overpaying for your home purchase.

You can lower your interest rate by 1/4%, 1/2%, or 1%, whatever you can afford or negotiate. The following real-life story will show you just one experience with the way this was applied with seller participation in buying down interest rates.

Important – Other Factors Which Effect Monthly Payment

Interest rate varies with many scenarios and interest rates also vary depending on when you are reading this. This is simply an example using 6.38%.

FYI side note; we are focusing on just the mortgage payment amount, the mortgage payment does not include any of the following that might exist… property taxes, special assessments, HOAs, homeowners insurance, or PMI (property mortgage insurance). We’ll break these down in a separate blog or video. For this, we are only focusing on lowering the interest rate.

This Might Surprise you, A Lower Interest Rate Could be Used to Buy a More Expensive Home

Another way to use this to your advantage, if you want a home which cost a little more than your budget. What? Lower interest rate allows me to buy more expensive home? It can, I say use it strategically, for what purpose you want. You want a lower payment, great, you want a little more expensive house, great. Some want a better house and this could also be the strategy to get it, here is how. Lender’s tell you what price of home you can afford based on monthly payment. If you buy down the interest rate, it allows for buying a bit more expensive house with the same payment. As in the example a mortgage payment for a $680,000 loan at 6.38 interest rate is 4,245 but at lower interest rate of 5.38 percent it is $3,810.

Should you not want to save on the monthly payment, you could purchase more home by the $435. per month. A $750,000 mortgage at 5.38% interest, the payment would be $4,202, still less than the $4,245, see what I mean? That’s for a $70,000 dollar increase in price range. Some food for though. Every thing is about using the best strategy for to get you the results best for you.

Real Life Story – Another Strategy to Lower Mortgage Payment

This buyer was moving from California to Colorado, bought this charming newer home built in 2019, 3 bed, 2 bath home.

They were out to buy their very first home using their VA bill. They were getting frustrated because this was the first half of 2022, homes were all overpriced and selling for much more than the list price. Out of frustration, not finding what they wanted for a price they were willing to pay, they tabled it for a few months. Something many buyers experience, maybe even you.

As the interest rates were going up and home prices stabilizing a bit, they realized they had to get in before they lost the opportunity for these amazing low interest rates, so they decided to look again.

Well Jackpot, they found one, A 3 bedroom, 2 bath, newer home with open floor plan, everything with reasonable bare minimum needs and wants, in a price range they were comfortable. The home was listed for $490,000. That would be a gold mine find here in California. 🙂

Here is the thing, they also wanted to avoid closing costs if possible, so they made an fair priced of $495,000. Due to the fact there was another offer, and they were also asking the seller to pay closing costs and fees up to $10,000. BTW, at $495,000, the home did appraise for a bit over $500,000.

How This Lower Interest rate affected Their Monthly Payment & How it Played Out

You might ask what this has to do with getting a lower interest rate, so let’s get into that. Closing costs were about $7,000, leaving $3,000 unspent monies. You lose what you don’t use so ha, the lender applied it to a buy-down which got them a lower interest by 1/4 percent. They were locked in at a 4.75% interest rate, with the $3,000 they were able to buy down their interest rate to 4.5%.

Every little bit helps, while it only brought her payment down by 74 dollars a month, you might be surprised to know that is $26,640 over the lifetime of the loan. Not bad for no out-of-pocket money to purchase the home.

Final results, they bought their home with 0 closing cost, 0 down, and got sellers also to pay for the buy-down of a lower interest rate of 1/4%. That’s how creativity in negotiations is done, as they have said… they are not mad about it! LOL If they would have paid the difference to buy it down and lower interest by 1%, they would have saved $290 a month equally $104,400 over the 30 years. I tell you that to show the impact but they did what they were comfortable with.

They were more than happy with exactly how this worked out. They could have had a lower interest rate, but in their situation, they choose not to, because they didn’t want to empty their bank account. The point of this story is to share a real-life circumstance on how to get results that suited their needs best, using a little creativity and ingenuity.

A Lower Interest Rate Packs a Powerful Punch

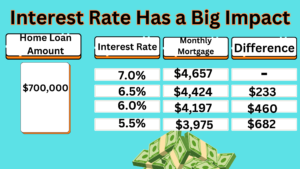

In summary, I did this chart to show you the powerful effect depending how the lower interest rate and buy-down affects a lower mortgage payment. Using a random $700,000 loan. It varies depending on your home loan price. As you can see, this is why I believe this is the most valuable consideration. If you can get seller to pay at least a part of the cost to lower your interest rate. So, let’s discuss other ways and strategy to help you use it . Imagine the difference over the lifetime of the loan between 7% and a lower interest rate of 5 1/2 percent is a whooping $245,000. THAT, makes it worth discussing.

(I’ll share their plan to become multi-millionaires using their VA, but that’s a story for another day.) 🙂

Strategy is to use a lower interest rate in different ways to get maximum benefits

Now, I am not trying to sell some hype, I am giving the reality of what is possible. If you have the cash, an option is to put less down and buy-down to lower interest rate, it’s a good way to save money in the monthly payment and additionally in the total amount of the loan.

This doesn’t mean every seller will contribute to lower your interest rate for you by a full 1%, most won’t. It depends on negotiations and circumstances, but it is easily conceivable to get a seller to help with getting a lower interest rate by 1/4 or 1/2 percent. It does make a difference in your monthly mortgage payment! Also, another possibility is for you AND the seller both to contribute to buying it down.

You see ultimately, we are here to guide you in what is possible to help you with your needs, which can vary depending on your situational circumstances. It is about knowing everything possible so, YOU make the best choices to help you.

IMPORTANT to know, not all buy-downs lower interest rates permanently either! That’s another topic for another blog, but you want to be sure you are not getting a temporary one! Temporary ones lower interest rates only for a few years, make certain you are getting a lower interest rate for the term of the loan or the type of buy-down you want. The example I gave you, and most often the best choice is for the life of the loan, unless you are only going to be living in that home for a few years. I wouldn’t spend the extra money to lower the interest rate if it was only for a couple years but I would not say no to seller paying for it. Except what if, you could just get a lower offer accepted, It all matters depending on your circumstances. So Again, strategy matters, always discuss your circumstances with your lender so you can make the best choice for you.

There are other ways to get the best monthly payment, which I will discuss those details in other blogs and videos, FICOS is another that can affect you, as mortgage insurance and property taxes can carry quite large Mello Roos to name a few.

Lower Interest Rates Make a Big Difference

I wrote a blog about 3 years ago showing you the difference it can make. In that blog I show the impact a higher or lower interest rate has on your mortgage amount. I let you know the government is more comfortable with interest rates around 7%. The reason I stated was because they use interest rates to control inflation. When rates were amazingly low and unprecedented, I warned you they would be back here. If you would like to read it, here is the link Should I Buy Now or Wait Until the Prices Drop?

If any of this Confused You, or Have Questions, Simple Ask

We don’t care if you are buying soon or in a few years, we are here to help you. If you have questions, you can feel free to call to ask without pressure. Set yourself up the best way to achieve your goals. We not only know the love of owning your own home, but we also completely understand this is one of your biggest, and one of the best investments for life.

Buying smart gets you further faster because you are not just buying your home, you are also investing in your future!

~Dianne Hicks

My quote for the day…

If there is a will,

there is a way,

even if it’s not today! 🙂

~ Dianne Hicks

To view homes available for sales OcPropertySisters.com

Our page for more article blogs, tips and tricks, pics, area info, pics, home search, and much more!

We will be adding videos with advise and area info soon on YouTube here at https://www.youtube.com/@ocpropertysisters