Comprehensive Guide to Orange County Property Tax Rates Including Percentage, Special Assessment Taxes, & Mello Roos

Planning to buy a new home in Orange County, California, can be an exciting, yet daunting experience. As a home buyer, it’s essential to understand the Orange County property tax rates, including percent, Mello Roos, and Special Assessments, to make an informed decision. Orange County has a reputation for being one of the most expensive areas in California, and understanding the taxes can aid you in budgeting, financing, and making better property investment decisions.

All Considerations Lead to Less Regrets Later

Not only will this blog post provide an in-depth guide on property tax costs, but it will address other impactful items I believe are also equally important to add to the considerations of your home purchase. Considering the entire scenario can provide the best chance to make the right decision regarding financial advantage in your home purchase investment and quality of life.

In Orange County, the property tax bill variance can easily add hundreds or even thousands more to the cost of your home. This is very important for first-time home buyers to know, therefore you need to understand and pay attention to it!!! The goal here is to help you understand what and where to pay attention to.

Those Pesky Mello Roos are what can be the biggest financial unexpected variable on your pocketbook regarding taxes. This is very important information for you to know BEFORE putting an offer on a home!!!

The Ease of Understanding What is On Your Orange County Property Tax Bill and Advise will be divided into four parts:

- The percentage for calculating the total dollar amount.

- An overview of Mello Roos and how they vary.

- Special Assessments explained.

- Other important factors to consider before making a decision.

Part 1 is Orange County Property Tax Rate Percent

Grab your coffee, there is a lot to take in but worth your time to read all the way through. It could make a big difference in your home-buying decision-making process. So Bucket up Buttercup. 🙂

Let’s get into Orange County Property Taxes, San Diego County, and Riverside County these counties are all about the same.

The Orange County Property Tax percent is the simple part to understand, and it’s the part everyone will have to pay in Orange County.

The base Orange County property tax costs are a percentage of the home’s assessed value at the time of purchase. This base property tax percentage is right about 1% for Orange County, San Diego County, and Riverside County. Our property tax rate may be relatively low, yet the value of our homes exaggerates it.

Let’s do an example so you are clear how to figure this part out.

In this example, we’ll say the home you want to purchase has an assessed value is $700,000. In calculating the Orange County property tax, it’s a solid estimate to take an avg tax rate percent is 1.03013. $700,000 times 1.03013% = $7210.91. Yearly taxes will be approximately $7210.91 or approximately $600.91 per month. It’s important to note that property values and tax assessments can fluctuate due to market trends, inflation, and property improvements.

Worth Noting; Great news for home buyers, as your property value increases every year, you will be lock-in with only a 2% annual tax increase. Unlike in many states, where tax increases reach up to 10%, this advantage allows you to have control over your costs and be financially stable.

A quick and reliable method to estimate a home’s value is by calculating 1% of the purchase price. That will give you a good estimated idea of how much the base property tax will. Part 2 is where the rubber could hit the road with your decision on the purchase.

Part 2 – Mello Roos you’ll find on your Orange County Property Tax Bill

Let’s first review what Mello Roos are

Mello Roos Tax

The Mello-Roos tax is a special assessment tax imposed by local government agencies on properties within a Community Facilities District (CFD). CFDs are formed to finance the construction of public infrastructure, such as roads, parks, and schools, to accommodate new housing developments. Homebuyers who purchase a property in a CFD area, have to pay an additional Mello-Roos tax, which usually lasts for 20-40 years. While most have a time payment expiration period allocated, I have seen a few that are fixed for the lifetime of the home. The few I have seen with no expiration date have been usually tied to road maintenance upkeep for the area. It’s important to research and understand which properties are subject to Mello Roos tax, as it can add thousands of dollars to your annual property tax bill. These will can also be on your tax bill.

The builder then transfers those costs attached to that home, when a buyer initially first purchase’s the home. Those assigned costs travel with the home until that specified term expires. Unlike the property tax percent, these are usually fixed yearly amounts regardless of the price of the home value.

These costs are very unpredictable and predictable. LOL By that I mean, each area can be different, you won’t know unless you ask. Each home builder can have so many variables that they determined an assigned cost to each different home individually. These costs can be comprised of multiple bonds and can also vary by the amount of allocated time these costs are to be paid. Questions you should ask, how much and for how long.

Let’s do an Example to Clarify How This Effects You Financially on Your Property Taxes

For example; Let’s say, the total when the first buyer initially purchased the home, Mello Roos totaled $5,000 a year for that home. When the home sells, the $5,000 will then transfer to the new owner’s property tax bill, if they are not paid off.

If that $5,000 was initially for 30 year time period. If that said home is now 10 years old, you would assume that $5,000 a year for only the next 20 years. The payment and the time transfer with the sale.

How Your Orange County Property taxes bill, Comparison Mello Roos Impact on Your Monthly Payment

Alrighty, now let’s move on with another example of some Special Assessments and Mello Roos.

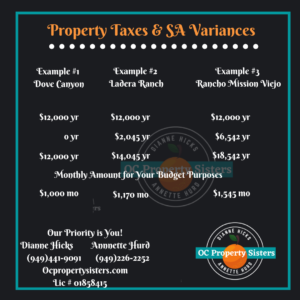

For this example, I’m taking 3 neighborhood areas, Dove Canyon, Ladera Ranch, and Rancho Mission Viejo for this particular example. These are wonderful and highly desirable areas here in South OC. I choose I used a home purchase price of $1,200,000 because that is a price range that all 3 areas can have in common.

The first line on the photo in the example is the estimated property tax. The second line is a combo of Special Assessments and Mello Roos. The third line has the yearly totals. Finally, the fourth line has a monthly amount for your budget purposes. In this example, as you can see, the difference between Dove Canyon and Rancho Mission Viejo is $542 a month. That gives you a great idea of the impact it can have.

The special notation here is also a consideration. Dove Canyon doesn’t have the Mello Roos because they have been paid off. Ladera Ranch building started back in 1999 and continued through the market crash so some of those bonds could be ending soon. Rancho Mission Viejo in contrast is much newer, so those Mello Roos on your property tax bill will be paid for a much longer period.

The big question to ask yourself is, how much are the Mello Roos and how much time will you be obligated to pay it? Is it worth it to you to pay those additional costs which will be property tax impacting the overall cost of your home? Part 4 is where I discuss other important considerations that could have a thoughtful financial impact on that decision.

Part 3 Special Assessments.

Special Assessments

As we discussed Mello Roos in detail, they are considered a type of special assessment, they pack the biggest financial punch.

There are others, which are generally minor you may find on your Orange County property tax bill. They could be direct levies or charges for delinquent county bills. In addition, there are fees added which are tied directly to the Jurisdiction. Always good to check but most don’t amount to much. For example, many of the areas in South OC are $20.00 a year. Always good to check but in most cities, they are minor charges. Irvine adds a landscape fee (lol). Some cities can add put your trash collection to the bill.

Part 4 – Where Other Hidden Factor Cost and Lifestyle Also Play an Important Part of Your Decision

Here’s is What You Really Also Need to Have a Closer Look and Pay Attention to These Details

First things first though, you need to know, if purchasing that home with those additional Special Assessments and/or Mello Roos costs, are they in your lender’s calculations and/or is it in your budget?

Those additional fees can push you over the edge of your home-purchasing financing choices. It can affect you both financially and emotionally.

Financial because you might not be able to afford it.

Emotional because, it is devastating to fall in love with the idea of that being your home, then find out you can’t afford it.

Here is what I believe is the best strategic approach, to avoid the stress of both the financial and emotional decisions before looking at homes you are interested in buying.

.

Your lender is aware of property taxes rates and has compensated for them. However, may not have considered or compensated for the entire amount of Special Assessments and Mello Roos. It matters. When Lenders tell you the home price they were willing to finance, they estimated the property tax. Lenders are all different, often using a variety of estimated tax considerations. You need to know, did they consider any additional amount for Special Assessments and Mello Roos, if so, how much?

My Suggestion to Handle This is a Very Simple Solution

My strong suggestion is a very simple solution, it’s one thing I always do if you are my buyer. I always ask the lender upfront, what is the tax equation you estimated AND what did you estimate for HOAs in your loan approval? Both of those are important to know upfront. If I am not your Realtor, you should ask. I discuss this with you and its impact how it affects your home purchase power preview.

Sometimes you can buy a higher-priced home or a less expensive home, depending on those specific Lender’s answers. The lender gave you a home price based on their calculated monthly cost to you. The more facts you know, the better choices you have, to make the decision best for you. I will be writing a blog soon, to show you how not all homes priced the same, are the same but you get a part of it by seeing how these Special Assessments and Mello Roos can affect your monthly payment.

Don’t Skip These When Analyzing Monthly Cost.

It is Mostly Older Homes Free From Special Assessments and Mello Roos, but Can Have Additional expenses.

Although you may save money in Special Assessments and Mello Roos on an older home, the older homes are generally not as energy efficient as the newer homes.

Sometimes that difference that you will pay in higher utilities is significant. It can even be close to what those additional fees cost. The insulation, windows, air conditioners, heaters, and other factors are often not as energy efficient unless the property has been upgraded regarding these items.

Although you probably will use the home differently, it is not a bad idea to ask for a recent copy of utility bills for summer and winter. Those utility bills can give you a perspective of the impact to help with your decision.

In addition, an older home can need repairs sooner and/or the modernization you desire. Those can be high ticket-priced items, a newer home may not need. It’s an important consideration, for roof life, and air conditioners, if you want to open up the design, just think about what you will need and/or want to change.

It’s worthy of consideration because, in the long run, it may cost you much more, yet may not grow your investment as fast. With these possibilities, this is surely worth considering. The cost sounds more but indirectly, it could even be a saving for you in the long run.

Another Factor Worth Considering.

Don’t kill me, but I think this is also worth consideration. Are you going to be driving further from one to the other? Is there a distance between your choices? How does that play into the financial cost of living there?

Here’s the thing, with gas prices the way they are, it can have an indirect have an additional impact on expenses for that home. Even if you have to drive an extra 10 -15 minutes that could add a fair amount of expense, not to mention your time to your choice. I prefer to bring these into the conversation because I don’t want you to have regrets later.

Why You are buying This Home, Matters in the Decision

It is also important to think about if you want to put down roots in this home, or just stay for a few years. Does it grow your investment wisely?

Do the area and neighborhood suit your lifestyle?

Often when you are purchasing your first home, it’s a stepping stone and sometimes you just got to do what you can sacrifice, and do only what is necessary to get you started. If that is the road you are taking, maybe it is wiser to purchase a smaller place in an area that has a better chance of growing your investment.

We can discuss and help you with information regarding some of those factors and choice considerations, to help you make the right decision for you.

With that said also worth noting; You should speak with your accountant regarding how it will impact your income taxes, regarding what’s on your Orange County property tax bill. I say this because, in brief, property taxes can help reduce your taxable income. However, Special Assessment and Mello Roos in general, do not qualify to reduce your taxable income. That deserves financial consideration.

This is one of the biggest investments in your life so make a wise choice that is best for you!

Warning, Lastly, this can also be an Unexpected Surprise on the Orange County Property Tax Bill

Now, kind of hiding a newer program HERO financing liens through property taxes… In a nutshell, when someone upgrades to more energy-efficient items, they sometimes finance them through a HERO program. This HERO program allows them to be added to the property tax bill and is repaid over time when paying your property bill.

If the seller has an unpaid HERO bill being paid through the property tax bill, it must be resolved before closing on a home. Either the seller needs to pay it off or you must be transferred and assume the balance.

I say surprise because the seller and/or seller’s agent don’t often disclose this. When putting an offer you should know this because depending on who is paying for it, it can affect what you would offer for the home.

It can be a deal breaker, so the sooner you know this the better off you. If the seller refuses to pay this off, even if you agree to pay it, it can also change your monthly house payment amount. I believe the best and only way to handle a HERO bill, these facts need to be addressed and considered before putting an offer on the home. It can also snowball because it could also impact what your lender approved. You don’t want that unexpected financial surprise.

My suggestion if I am not your agent, have your agent verify if a HERO bill exists on the property tax bill. That way, you head off a maddening problem in escrow, and you know the facts before your offer.

When are Property Taxes in Orange County Due?

Property taxes are paid twice a year. The First Installment is due and payable on November 1st, It will be considered delinquent after December 10th. There will be a 10% penalty added to unpaid accounts. The second installment of your property taxes is due February 1st. It will be considered delinquent after April 10th. A 10% penalty will be added to unpaid accounts.

Here is a link to where you can pay your bill and interact with the government regarding problems Orange County Property Tax website.

However, it is not uncommon for your lender will pay your property taxes from escrow. They collect them when you pay your monthly payment, at the time you pay your mortgage. Your lender then deposits your property tax payment into an escrow or impound account. When your property taxes are due to the county, your lender uses those funds in that escrow account to pay the taxes on your behalf.

When you purchase your home, make sure you have a clear understanding, will it be you or your lender who will be responsible for payment of your property taxes to the county?

Conclusion and Recap of Questions to Ask

Buying a home is one of the most significant investments a person can make in their lifetime. It’s essential to have a comprehensive understanding of property taxes, including percent, Mello Roos, and Special Assessments, as they directly affect the homes’ overall cost of ownership. Understanding these taxes can be complicated, but with the right guidance, you’ll be able to make informed decisions that can save you money in the long run.

The bottom line for part 1, 2, and 3, The Bulk Charges On Your Orange County Property Tax bill.

(Property Tax rate x Assessed value) + (total special assessment + Mello Roos) for the year = total tax bill for year.

Divide by 12 to figure the approximate monthly tax bill amount.

After understanding how all these impact the cost of your home, here is what I recommend. I advise my clients however, if you are not my client and are buying a home, I urge you to ask your agent the following questions.

Questions I highly recommend before looking at the home.

“Are there Mello Roos?”.

If the answer is Yes, “How much are they a year?”.

I would also ask “What are Jurisdiction taxes under the Special Assessments as well?”. Minor as they may be, I’ve seen them range from as little as $20 to a little over $1500

Questions to Ask about tax bills before putting in an offer

Does the seller have a HERO bill on the taxes?

If you know someone buying a home, especially if it is a first-time home buyer, please help them by sending this blog. Too many don’t know the right things to ask.

While I primarily wrote this for Orange County, San Diego, and Temecula areas, once you understand this, the same principle will apply no matter where you are in California. All you need is the county tax percentage.

Looking for a Home?

Visit our website to help you with your home search needs. We have all the resources you need to find a home that matches your needs. Visit our website OC Property Sisters to get started in search of your dream home. Don’t forget to read through our Neighborhood Reports for a detailed overview of all of Orange County’s cities and communities. Thank you for considering us as your source for all things Orange County! We look forward to being a part of your journey. Contact us today and let’s get started! 🙂

We’re here to help make your home search as easy as possible for you. Feel free to reach out with any questions or if there is anything we can do to assist you

Happy house hunting! 🙂

Check Other blogs or Home Searching Info in Orange County here

For those seeking condos, don’t miss out on this incredible resource: “Condos for Sale in Rancho Santa Margarita – My Ultimate Guide.“ Explore the comprehensive guide that provides valuable insights and assistance in finding your perfect condominium.

If you unfamiliar with RSM, here is My Top 5 Reasons for Living in Rancho Santa Margarita.

A little about Rancho Santa Margarita lake area Rancho Santa Margarita Lake.

This could save you hundreds a month, When buying your home, this is really worth your time to read.

To view homes available for sale OC Property Sisters

We look forward to being a part of your journey. Contact us today and let’s get started! 🙂

Thinking about Selling or Buying in Orange County, San Diego, or Temecula Area… We are just a phone call, text or email away with any questions you may have or in helping with the choices that are best for YOU!!! Wishing you all the best in moving forward down this wonderful crazy wild adventure of life.

Quote for the Day…

The way you look at things is the most powerful force in shaping your life.

~ John O’Donohue

Thank You,

Your Local Realtor

OC Property Sisters

Orange County Real Estate Expert.

OC Property Sisters

website; OCpropertySisters.com

Email: ocpropertysisters@gmail.com

Phone, text, email, or schedule a meeting.

Dianne Hicks; 949-441-9092

Annette Hurd; 949-226-2252

Fathom Realty

BRE License # 01858415